Create Account

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Don’t have an account ? Register

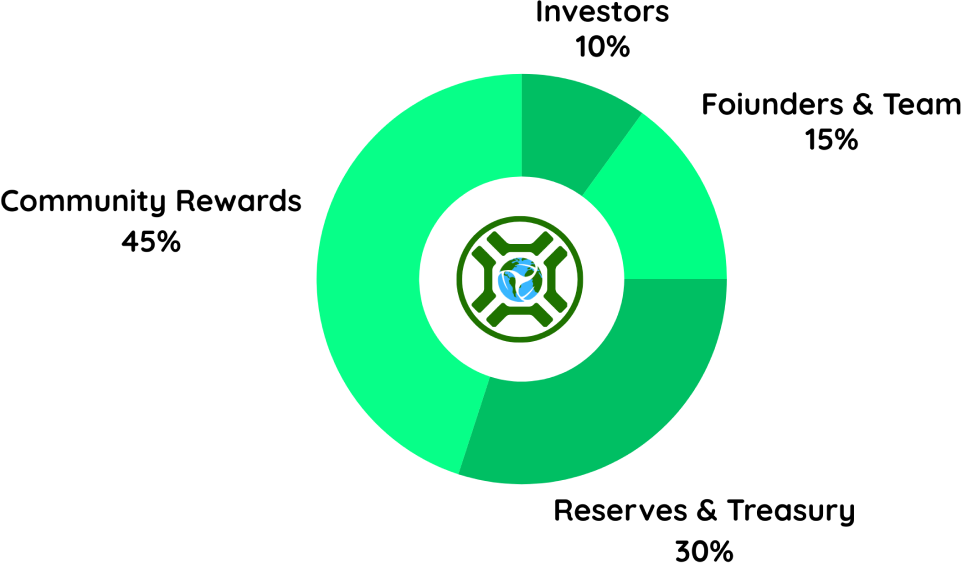

This significant allocation underlines our commitment to community engagement and user-centric growth. By rewarding participation, loyalty, and contributions, we aim to foster a vibrant and active user base, crucial for long-term network effects and sustainability.

Reserved for future operational needs, contingencies, and strategic initiatives, this allocation ensures financial stability and flexibility, allowing us to adapt and innovate continuously.

Reflecting our long-term commitment, this allocation aligns the team's incentives with the enduring success of the ecosystem. It underscores our philosophy of building a robust and enduring platform, rather than short-term gains.

Note: This budget will be used very conservatively as we believe that giving a large share of tokens to the internal team frequently leads to adverse incentives that prevent the growth of a long-term ecosystem.

Unlike typical tokenomics models, our investors receive company equity instead of tokens, mitigating the risk of a massive sell-off in the 2-4 year vesting period typical in other projects.

The 10% is a flex budget for the future in scenarios where NEC needs to expand and use tokens to raise capital in the future.

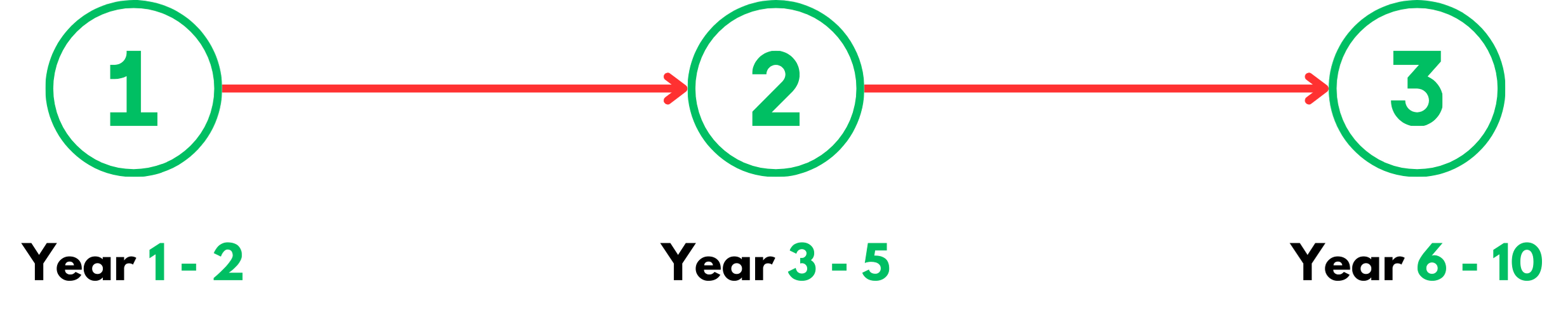

AggressivAggressive disbursement to stimulate growth and network effects, with 10%.

Moderate disbursement, with 7% (2.52 billion tokens) distributed per year.

Slower disbursement, with 3% (1.08 billion tokens) distributed per year.

Conservative disbursement to support operations, with 2% distributed per year.

Further reduced disbursement, with 1% distributed per year.

Vesting over 10 years with a gradual release, totaling 10% by the end of year 10. Vesting will be dependent on growth of the company, so dispersions early on will be much smaller until the company and token economy grow to a healthy number in which disbursement can be made without shocking the price of the token

Given the equity-based compensation, disbursement of tokens will be minimal, aiming for 2% over the first 10 years. The rest of the tokens will be in reserve for potential opportunities that may extend beyond the 10 years

In the initial phase, tokens are distributed more aggressively to promote exposure and user engagement. This phase focuses on genuine customer acquisition, with a vigilant approach to distinguish between authentic participation and token manipulation by bots. Token rewards for node validators are modest, emphasizing a balance between incentivization and sustainable token economics.

Here, rewards and disbursements are closely tied to revenue and customer acquisition metrics. The approach is conservative, keeping tokens in reserve for potential scaling needs. This phase represents a transition from aggressive growth tactics to a more stable and sustainable model.

In the final phase, the ecosystem matures, reducing the need for incentivization through free tokens. The focus shifts to governance and leveraging the blockchain for new ventures, potentially collaborating with other businesses. The goal is to establish NEC as a self-sustaining economy, where tokens have intrinsic value within various integrated ecosystems.

Download Tokenomics Document